Randolph hosts Amendment 2 town hall meeting

DiStefano

ELKINS — The Randolph County Commission hosted a town hall meeting at 4-H Camp Pioneer to discuss Amendment 2, which will be on the ballot for this November’s General Election.

Commissioner Cris Siler and Randolph County Assessor Phyllis Yokum led the meeting, which featured informational presentations from the West Virginia Association of Counties’ Jonathan Adler, and Seth DiStefano from the West Virginia Center on Budget and Policy.

Like many leaders from throughout the state, including Gov. Jim Justice, both guests spoke out against Amendment 2, which would give the West Virginia Legislature authority over the property taxes that currently fund county governments, school boards and emergency services.

Adler was first to speak and explained several different ways Amendment 2 would harshly affect counties and municipalities.

“As many of you may not know, this money we are talking about, these taxes, are in the state constitution and they are mandated to help local governments,” said Adler, who is WVACO’s executive director. “They go mostly to our schools, about 67 percent. Then 27 percent goes to county governments and just a slither goes to the state right now.”

Adler told the crowd that getting rid of their car tax wasn’t worth all the damage the amendment would cause locally for each county in the state.

“The supporters of this say ‘hey, folks, if you want to get rid of your car tax, support Amendment 2,'” Adler said. “That’s how they are selling this to you. It’s about a car tax they are giving as a gift to you and everything is going to be hunky dory. But there’s a heck of a lot more to it than that.”

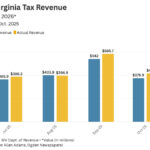

Adler said if the amendment passes, the state Legislature will be taking about $600 million from local governments and schools and will use it whatever way they decide to do so. Close to $140 million from car taxes and another $400 million from business taxes will be affected by Amendment 2.

“You see who is going to benefiting from these tax cuts,” Adler said. “It’s going to be the businesses.”

Adler said funding for local libraries, volunteer fire departments, emergency squads and youth sports teams are among the many entities that will suffer if the amendment is passed.

“If you pass this, if you vote for this, it takes the mandate out of the constitution and it gives the authority to the legislature to see how they want to allocate these monies going forward,” Adler said. “Funding for the local community is going to go away.”

Adler explained what the process will be for those seeking funding if Amendment 2 passes.

“Counties are going to lumped into the general revenue funds like everyone else, having to compete with all the state agencies that need their funding,” he said. “All 55 counties and these entities, and the county governments themselves and schools, are all going to have to go to Charleston and say please give us our money.

“I can see kids right now running around down there in their baseball and football uniforms trying to get money. What a waste of time and effort to do those things. They (the state) have so many things on their plate they have to fund, now they want to create another $600 million hole that they are going to have to fund.”

Amendment 2 would give the legislature the authority to reduce or eliminate six categories of tangible personal property taxes, including that on machinery and equipment, furniture and fixtures, leasehold investments, computer equipment, inventory and motor vehicles.

Proponents of the amendment have said the elimination of the machinery and equipment tax will bring more businesses to West Virginia.

“Less than 30 percent of the revenue generated from Amendment 2 comes from the personal vehicle tax,” said DiStefano, policy outreach director at the WV Center on Budget and Policy. “Over 70 percent comes from the machinery and equipment tax. This is a big business tax cut. We did some math and found that your average West Virginia household is only going to benefit to the tune of about $3.50 per week if their vehicle tax is eliminated.

Distefano said Amendment 2 will take funding from many basic needs, like emergency services and education, that every county has to have in order to survive.

“Everybody is going to get hurt when emergency services get cut in half,” he said. “And I can’t imagine what a $445,000 cut to the school system is going to do.”

Laura Ward, one of several local citizens who spoke during the meeting, is director of the Randolph County Senior Center. She said the amendment would destroy senior services and public transportation in the county.

“This amendment is going to affect the senior center and it’s going to affect public transit,” said Ward. “Public transit is a 50-50 match program and if we get no money from the county, there will be no public transit. The $35,000 we received from the county this year equaled $70,000 in public transit funding alone. And I’m not even touching on the $60,000 that is in the budget for nutrition. We are the biggest county east of the Mississippi and we have a very elderly population. This just can’t happen.”

Delegate Cody Thompson, D-43rd District, was also in attendance and provided some information to those on hand.

“In Randolph County we have all these different schools that we have to maintain, we have to keep them and we have to have teachers in them, and whenever we constrict this funding, it’s truly terrifying,” Thompson said. “There are four amendments on the ballot and three of them are concentrated on a power grab for Charleston.

“That’s all it is for the legislature, is a power grab for the legislature. They want to take all the power basically away and oversee every single aspect of the state board of education.”

Siler pointed out that other things needed to be done in order to bring businesses to the Mountain State. He said eliminating just one tax wasn’t the golden ticket to making that happen.

“They think by eliminating these taxes on machinery and equipment that all these businesses are going to magically come to West Virginia and build factories and plants, and that’s not so,” Siler said. “If we don’t fix our infrastructure, have housing, have proper education, and have EMS or fire service, you’re not going to get any of that. It doesn’t matter how much tax you get rid of, if you don’t have these things in line, nobody is coming.”

Yokum said that she wanted to point out the way that Amendment 2 is worded on the ballot, where it begins by stating “giving the authority to the legislature.”

“That’s what we want to think about,” she said. “Do we want to keep our local government or do we want to hand it over to the state government?”